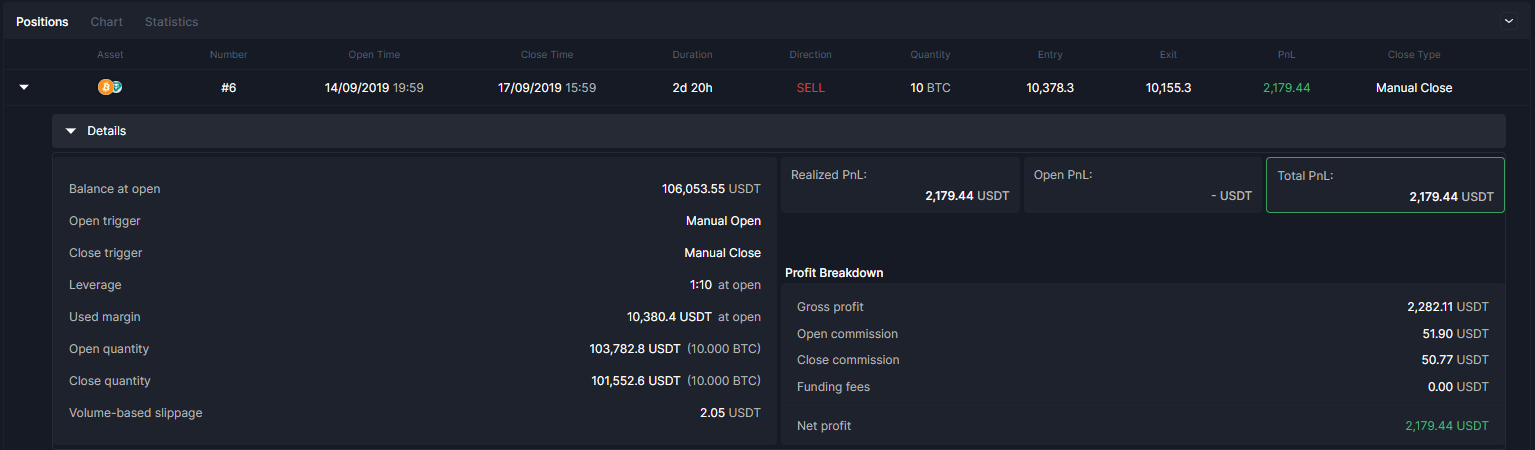

Manual Backtester gives you access to detailed and accurate stats for every position. The detailed expandable position table gives you a complete view of your trading approach, helping you analyze, improve, and fine-tune your best trading ideas. The detailed insight is presented in 4 categories: Position details, Trades list, Take Profits, and Stop Loss. 1. Details Tab The details tab displays essential information such as position ID, triggers, leverage, quantity, and average open price in one place. With cleo.finance, you can track all associated transaction costs with every position. Gain full access to your transaction costs linked to your exchanges, understanding how they impact your profitability. Other platforms often leave you unaware of these fees, which eat into your profits. All fees directly come from the exchange API data feed.

- Realized PnL Breakdown: Easily explore gross PnL, open and close commissions, funding fees, and Net PnL. Commission and funding fee data are collected every 8 hours only when the position opened and closed. This transparency helps you understand the impact of these factors on your overall results.

- Slippage Breakdown: Reveals details about slippage in your positions, including expected price, average execution price, and slippage (Expected Price – Incurred Slippage). This section focuses solely on slippage and does not include spreads and commissions.

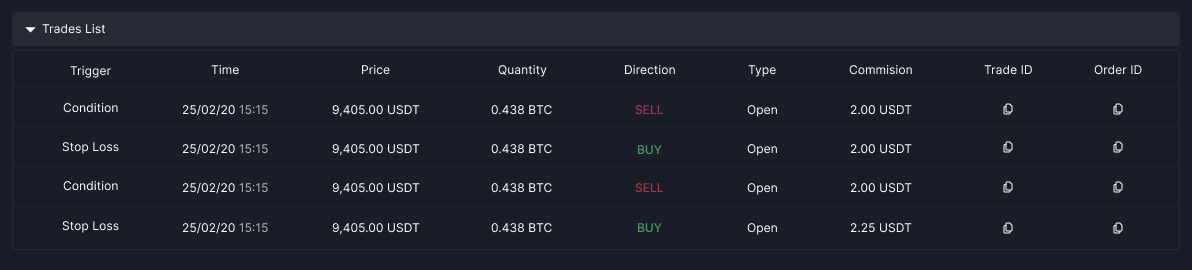

2. Trades List The Trades List provides data on trigger events, timing, prices, quantities, directions, commissions, and more. With a simple click, you can easily copy your Trade ID.

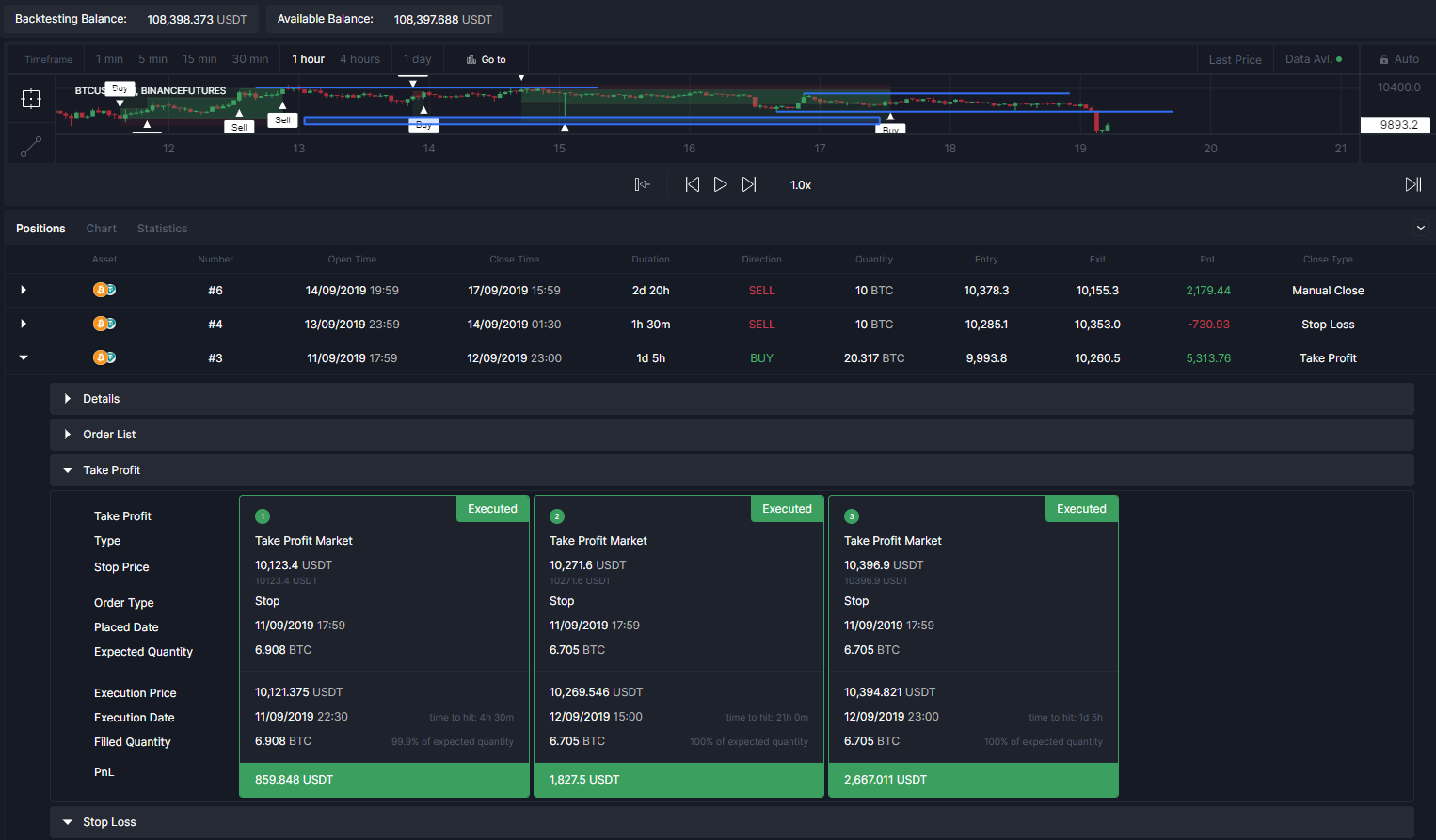

3. Take Profit and Stop Loss These two sections provide detailed information about the take profit and stop loss for each position. The take profit and stop loss section in the Manual Backtester offers valuable insights, including status, price, profit, PnL, execution date, percentage, initial price, last price, and last updated time for each position’s take profits and stop losses. To access these details, simply click on the expandable position table below the chart. The take profit and stop loss section of position details helps analyze trading performance, identify strengths and weaknesses, and optimize strategies.

-

- You can see how close or far you were from your target prices, how much profit or loss you made, and how long it took to reach your goals which can help you to evaluate your accuracy, consistency, and risk-reward ratio.

- Finding out how you adjusted your take profits and stop losses according to the market conditions, and how you exited your positions. With provided details on your take profits and stop losses you will be able to assess your discipline, flexibility, and exit strategy better.

- Learn from your mistakes. You can see where you made errors, such as setting your take profits or stop losses too tight or too wide, missing opportunities, or holding on to losing positions. Identify your weaknesses, avoid repeating them, and improve the way you trade.

The take profit and stop loss details are designed to provide you with a more holistic, realistic, and unbiased approach to your backtesting experience. It gives you the opportunity to constantly improve your trading ideas without spending countless hours on calculations, confusion, and gathering accurate data.