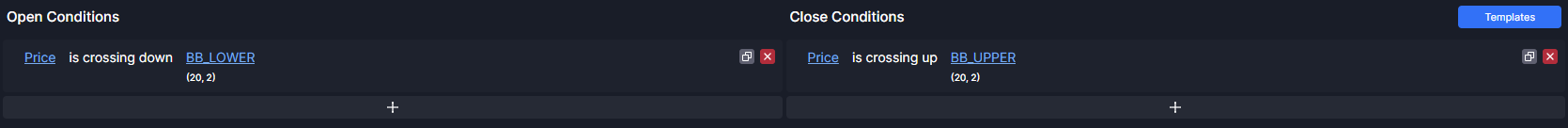

In Smart Trade, you are able to create your own custom entry and exit conditions by typing or simply selecting from the data-rich dropdown and automating your trading setup to open a one-off position. The conditions can be based on indicators (RSI is crossing up 30), candlestick patterns (candle is bullish hammer), price correlations to other assets, divergencies and more.

You are also able to backtest your automated trading strategies before actually deploying them live.

You can do further customization for each condition by editing its parameters in terms of period, time frame, inheriting an asset, etc, and more. After creating your conditions, the Asset Management tool lets you define your leverage and initial margin, and you can set multiple stop losses and take profits.

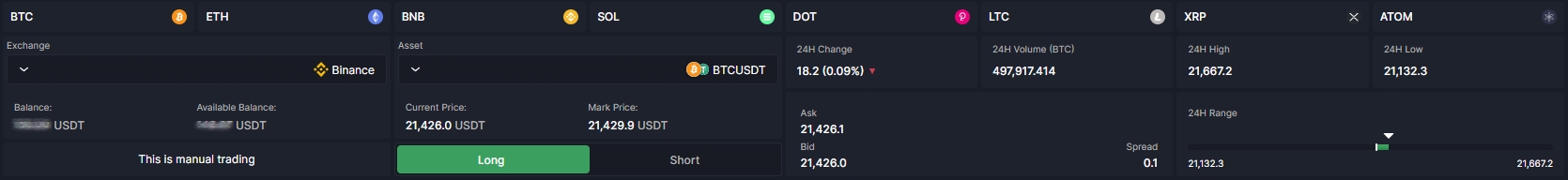

In Instant Trading, you can define your leverage and initial margin, and you can set multiple stop losses and take profits and place your trades instantly.

We will be covering all those in detail throughout the documentation

Visualize and Modify

Once you set your position, you are able to view and modify it right on the chart if you like.

Instant Trade

In Instant Trading, you can trade an asset using Market order, with up to 4 Take Profit and 4 Stop Loss orders.

In Instant Trading, you don’t create entry and exit conditions like in Smart Trading. Your position opens immediately and your position is closed by your stop losses and take profits.

Smart Trade

In Smart Trading, you are able to create your custom entry and exit conditions from a data-rich dropdown menu. You can either create your conditions by simple typing or you can select them on the dropdown menu.

With Smart Trading, you can create your own custom trading bots instantly. There are 2 options in the Smart Trade automation:

With Smart Trading, you can create your own custom trading bots instantly. There are 2 options in the Smart Trade automation:

- Smart Trade: This option allows you to automate your ideal Smart Trading setup to be triggered only once when your conditions are met.

- Automated Bot: Allows you to automate your trading setup perpetually and lets you analyze your strategy’s performance with its extensive statistics. You are also able to replay your Bot’s position history via the Position Replay tool.

Your conditions can be customized further when you click on them. You can adjust their periods, exchange, asset, and time frame.