In this section of the document, you will find;

What is Stop Loss?

How to set your Stop Losses?

How are the parameters calculated?

The warning messages and their explanations.

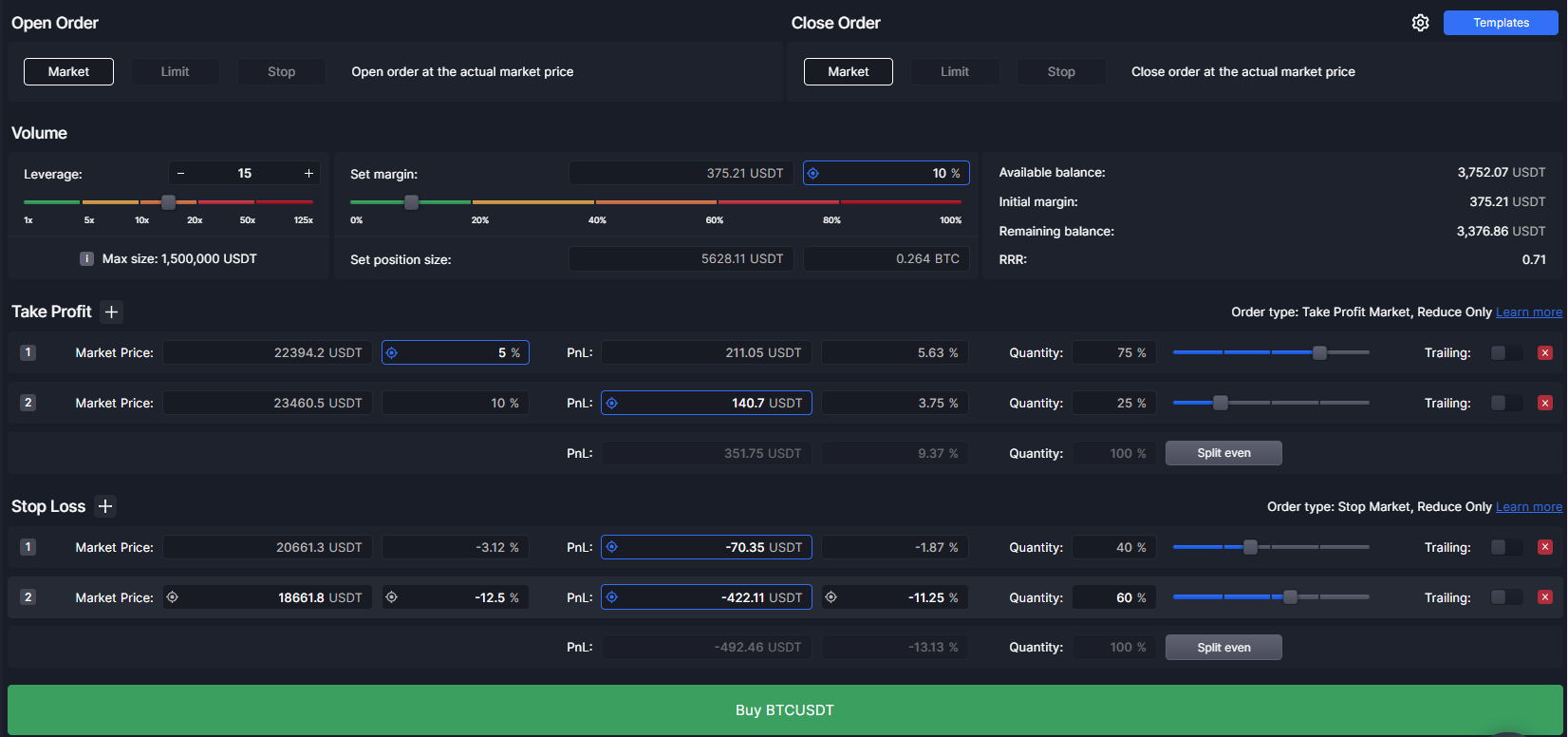

On Cleo Trading Platform, you can set up to set 4 Stop Loss orders.

Just like in Take Profit, you can use Stop Losses with either Advance mode or Basic mode.

On the Advance Mode, you can set any of the four data input as your target by clicking the target icon which will choose that data input as the main method of calculation.

Common Errors Messages

The Quantity of all your Stop Loss orders must equal 100%

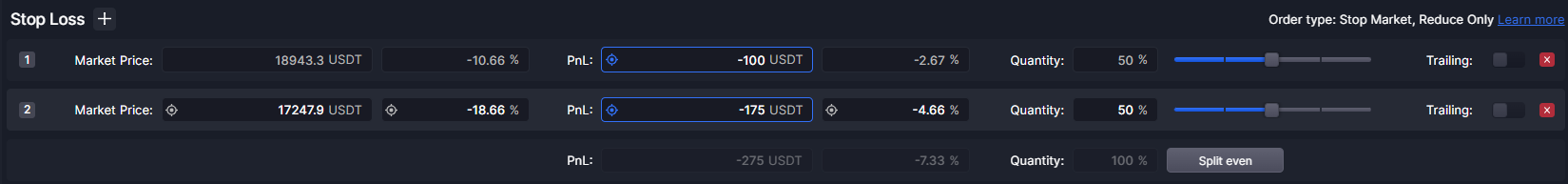

The sum of your all stop losses should be equal to 100%. So that means if you have:

One stop loss; then the quantity should be equal to 100%.

Two stop losses; then the sum of Stop Loss 1 and Stop Loss 2 quantities should be equal to 100%. You can customize the quantities of each stop loss via a slider or by just typing in numbers.The initial Stop Loss cannot be the same as current Market Price

In this error message, it means that the market price of your stop loss and the current market price for the pair you want to trade cannot be the same.

The initial Stop Loss cannot be higher than the Open Price

You will receive this error message when you set your market price higher than the current market price when you are in a long position.

Let’s assume the current market price for BTC/USDT is 47,000 USDT so this means that you cannot set the market price for your stop loss higher than or equal to 47,000 USDT.

The initial Stop Loss cannot be lower than the Open Price

You will receive this error message when you set your market price lower than the initial market price when you are in a short position.

Let’s assume the current market price for BTC/USDT is 47,000 USDT so this means that you cannot set the market price for your stop loss lower than or equal to 47,000 USDT.

The PnL of this Stop Loss cannot be 0

You receive this message when you set your PnL and PnL/Available balance of your stop loss to 0.