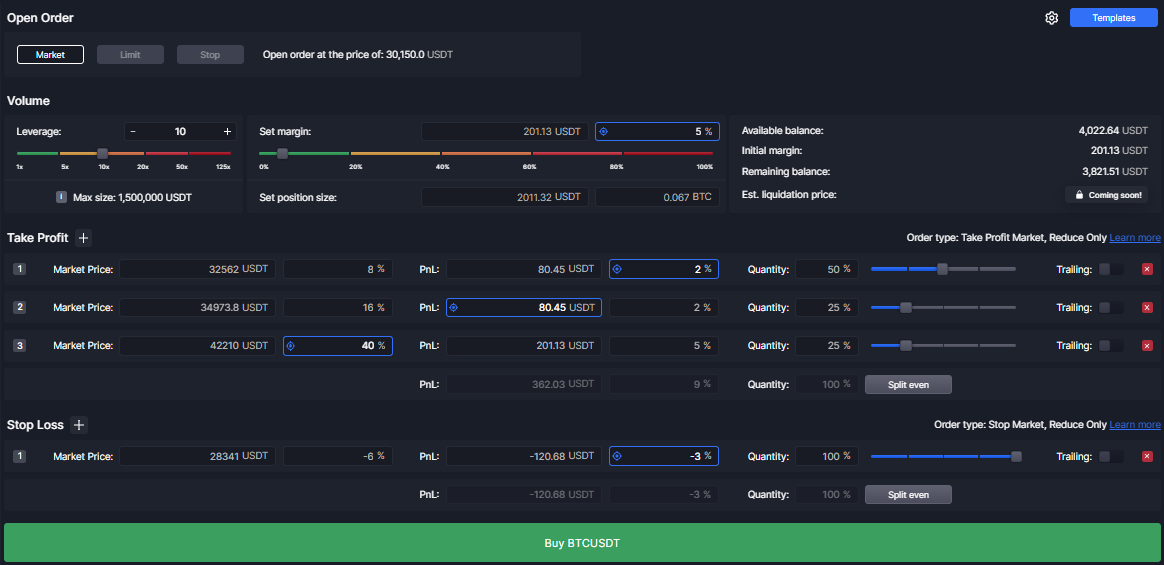

The Asset Management section allows you to set many crucial position attributes.

In this section of documentation you will find all needed to understand how to utilize Cleo’s unique options to maximize your trading performance.

Throughout the Asset Management section, we use the “target” icon.

Since in the Advanced mode you are allowed to see all 4 methods of data input at the same time, you need to set which one is the main method of calculation. The remaining three options are only approximated and visualized for you.

There are some readily available templates that you can use.

You can preview them, pick them, and even customize them the way you want.